“IASB outlines steps to improve disclosures in financial statements,” announces a recent news release.

Here’s how the release sums up those steps:

- “The International Accounting Standards Board (the Board) has today published a Discussion Paper that suggests principles to make disclosures in financial statements more effective.

- The Discussion Paper Disclosure Initiative—Principles of Disclosure seeks public feedback on disclosure issues the Board has identified through outreach as well as its preliminary proposals to resolve these issues. Ultimately, it is expected that the Discussion Paper could lead to amendments to IAS 1, the Standard covering general disclosure requirements, or the development of a new general disclosure Standard.

- Stakeholders have said that financial statements sometimes include too little relevant information, too much irrelevant information and information disclosed ineffectively. The Board believes that the development of clear principles governing what, how and where information should be disclosed in the financial statements will improve the information provided to users of financial statements. It will do so by helping companies communicate their disclosures more effectively and by assisting the Board in improving disclosure requirements in IFRS Standards.

- Some specific suggestions in the Discussion Paper include:

- seven principles of effective communication, which could be included in a general disclosure standard or described in non-mandatory guidance;

- possible approaches to improve disclosure objectives and requirements in IFRS Standards; and

- principles of fair presentation and disclosure of performance measures and non-IFRS information in financial statements, to ensure that such information is not misleading.”

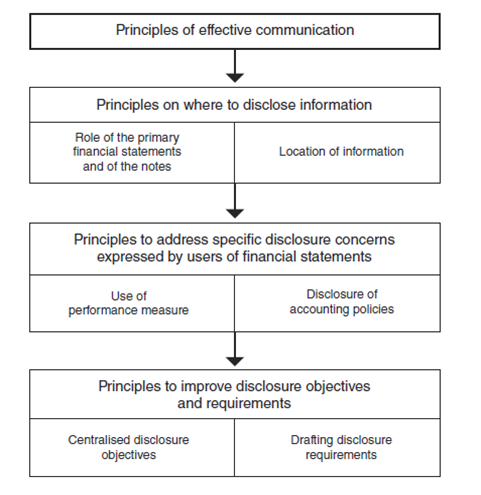

Here’s a visual summary of the overall structure:

Given that this is some way away from leading to any changes to standards (comments needn’t be submitted until October 2, 2017), many will probably see the paper as something that can be left to specialists. It’s still an interesting read though, for how it tries to bring specificity to aspects of IFRS which are currently quite general; even in its current form, it might sometimes be a useful reference point for decision-making. For example, IAS 1.117 requires disclosing “significant accounting policies” including those “that are relevant to an understanding of the financial statements,” but the few brief accompanying paragraphs leave plenty of room for disagreement about what an issuer has to provide, and in how much detail. The discussion paper proposes that every accounting policy that an entity might theoretically disclose will fall into one of three categories, based on their degree of importance to understanding its financial statements; it attempts to distinguish between the three categories in some detail, and suggests that an entity should disclose policies falling within categories 1 and 2, but not those falling within category 3. Although for my money this might still be too much mandatory disclosure, the paper provides a better basis for discussing the matter than we currently have .

Linked to this is the issue of what information can be provided outside the financial statements and what can be incorporated into it by reference. On the same topic of accounting policies, the paper says: “If Category 2 accounting policies are not disclosed, users of the financial statements who are unfamiliar with IFRS requirements would need to consult IFRS Standards in order to understand the financial statements.” This might not in isolation seem true – for example, such detail could be provided on the issuer’s website, with a web address included within the notes. But the paper suggests elsewhere that such incorporation by reference would only be appropriate when the omitted information “is provided within the entity’s annual report” (IFRS doesn’t currently define that term, but the paper proposes doing so) – among other things, the IASB seems concerned that information provided on a website might be difficult to find or access, or might not remain available for the same length of time as the financial statements. It should be interesting to learn the range of comments on such matters.

Presumably though, the material relating to performance measures, income statement subtotals and the like will be among the most scrutinized. Here’s where the IASB currently stands on that:

- “The Board’s preliminary views are that it should:

- clarify that the following subtotals in the statement(s) of financial performance comply with IFRS Standards if such subtotals are presented in accordance with paragraphs 85–85B of IAS 1:

- the presentation of an EBITDA subtotal if an entity uses the nature of expense method; and

- the presentation of an EBIT subtotal under both a nature of expense method and a function of expense method.

- develop definitions of, and requirements for, the presentation of unusual or infrequently occurring items in the statement(s) of financial performance.”

- clarify that the following subtotals in the statement(s) of financial performance comply with IFRS Standards if such subtotals are presented in accordance with paragraphs 85–85B of IAS 1:

The paper seems to suggest that the last of those items might be particularly challenging. For example, it reports that some stakeholders have suggested that “entities can use the term ‘infrequently occurring’ to describe an item or transaction that has occurred more than once within a stated period—for example, within the previous five years—or that is likely to occur in the foreseeable future.” Others have suggested that “re-occurring items that are unusually large” might be disclosed separately. It’s not hard to imagine what a tortuous cookbook might lie at the end of such a road.

Anyway, that’s just a flavour of what you’ll find in the discussion paper, if you choose to read further. And as indicated, the IASB doesn’t mind if you take your time about it…

The opinions expressed are solely those of the author